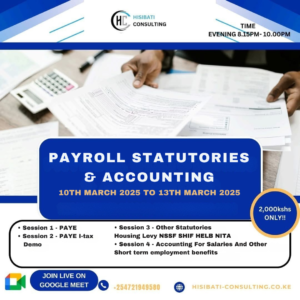

Payroll Statutories & Accounting (10th March to 13th March 2025)

- March 10 – 13, 2025

- 8:15pm to 10:00pm

- Google Meet

- 0721949580

Payroll Statutories & Accounting is for you; whether you’re a beginner or an experienced professional looking to stand out in your career. With practical hands-on learning approach we will cover;

Session 1 – PAYE

- Taxable Emoluments

- Tax Free Benefits

- Prescribed Benefits

- Non Cash Benefits

- Deductions

- Reliefs

- Primary Vs Secondary employees

- Resident Vs Non Resident employees

- Employee vs independent contractor

- Documentation and record keeping requirements

- Case Laws

- Tax Planning for PAYE

- Deadlines, Penalties & Interest

Session 2

PAYE I-tax Demo

Session 3

- Other Statutories

- Housing Levy

- NSSF

- SHIF

- HELB

- NITA

Theoretical Background

Filing Processes

Tax Planning

Session 4

Accounting For Salaries And Other Short term employment benefits

Follow this link to join our WhatsApp group:

https://chat.whatsapp.com/D1kAzXAhnAyHrun1JShchK

https://hisibati-consulting.co.ke/events/

SHARE[addtoany]

2025-3-10 8:15 pm

2025-3-13 10:00 pm

Europe/London

Payroll Statutories & Accounting (10th March to 13th March 2025)

Payroll Statutories & Accounting is for you; whether you’re a beginner or an experienced professional looking to stand out in your career. With practical hands-on learning approach we will cover; Session 1 – PAYE Taxable Emoluments Tax Free Benefits Prescribed Benefits Non Cash Benefits Deductions Reliefs Primary Vs Secondary employees Resident Vs Non Resident employees

Google Meet

save event to calendar

past event

0